To calculate the inverse correlation between two variables, you will need a set of paired data points for both variables. The symbol ∑ represents the sum of the values being measured. In this formula, x and y are the two variables being measured, x̄ is the mean of the x values, and ȳ is the mean of the y values. Here is the formula for the Pearson correlation coefficient:

#NEGATIVE CORRELATION EXAMPLES GRAPH SERIES#

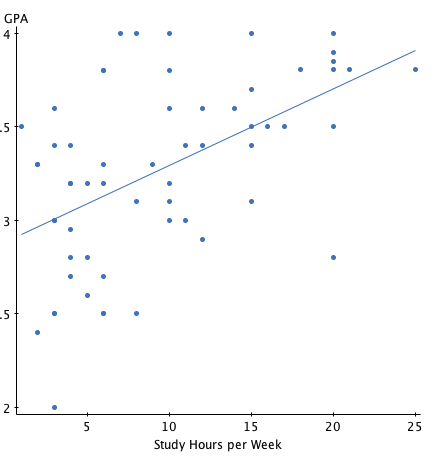

It’s also possible to calculate the correlation between one dependent variable and a series of other independent variables, such as an overall market. This is a statistical measure of the strength and direction of the linear relationship between two variables. You can use the Pearson correlation coefficient formula or you can find the covariance of each variable. To calculate the inverse correlation, or negative correlation, between two variables, there are two ways to approach it. A positive correlation has a coefficient between 0 and 1, where a coefficient of 1 indicates a perfect positive correlation. A coefficient of -1 indicates a perfect negative correlation, while a coefficient of 0 means there is no correlation between the variables. The strength of the correlation between two variables is measured using a correlation coefficient, which ranges from -1 to 1. For example, if the stock market goes up, the value of a bond may go down.

#NEGATIVE CORRELATION EXAMPLES GRAPH HOW TO#

In this article, we’ll delve into the concept of inverse correlation in investments, including how to identify and use it to make informed investment decisions. Understanding inverse correlation is important for investors because it can help them identify opportunities to diversify their portfolios and hedge against risk. Inverse correlation, also known as negative correlation, refers to a relationship between two variables in which one variable increases as the other decreases. 8 The Bottom Line What is Inverse Correlation?

0 kommentar(er)

0 kommentar(er)